How do you predict stocks for day trading?

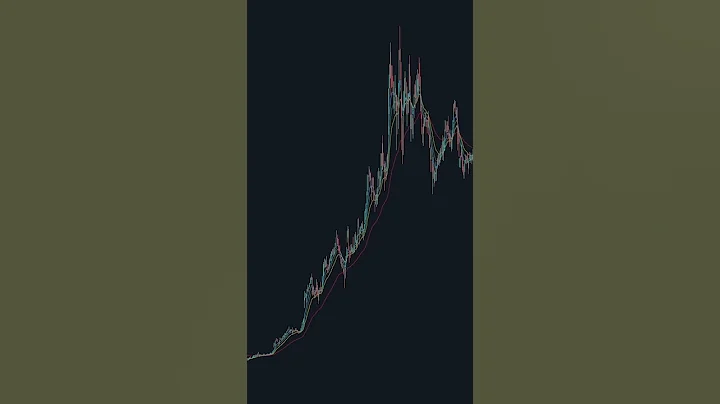

Stocks with a positive price trend – where the price is consistently moving upward – can provide excellent day trading opportunities. You can identify these trends by using technical analysis tools like moving averages, which smooth out price data to help identify the stock's trend direction over a specific period.

- Choose liquid stocks. ...

- Avoid volatile stocks. ...

- Invest in correlated stocks. ...

- Follow market trend. ...

- Opt for brokers that offer charting tools. ...

- Look for transparent companies. ...

- Choose stocks with a presence in the derivatives segment. ...

- Trade news-sensitive stocks.

The best stocks for day trading are those that experience high average daily trading volume, liquidity, and volatility within the stock market.

Price to Earnings ratio is one of the traditional methods to analyse the company performance and predict the prices of the stock of the company. This ratio considers the market price of the shares of the company and the earnings per share (EPS) of the company.

With a $10,000 account, a good day might bring in a five percent gain, which is $500. However, day traders also need to consider fixed costs such as commissions charged by brokers. These commissions can eat into profits, and day traders need to earn enough to overcome these fees [2].

You can find penny stocks on the regular stock exchanges and the OTC Markets. Find securities that interest you, then review their basic data. How long has the company been active?

- On-balance volume (OBV)

- Accumulation/distribution (A/D) line.

- Average directional index.

- Aroon oscillator.

- Moving average convergence divergence (MACD)

- Relative strength index (RSI)

- Stochastic oscillator.

The opening period (9:30 a.m. to 10:30 a.m. Eastern Time) is often one of the best hours of the day for day trading, offering the biggest moves in the shortest amount of time. A lot of professional day traders stop trading around 11:30 a.m. because that is when volatility and volume tend to taper off.

Day traders may hold stocks for a few hours, while buy-and-hold investors may hold onto a stock for decades. There is no single formula that works for everyone when it comes to deciding how long to hold stocks.

While there is potential for large gains, there is also a significant chance of significant losses. This is an important point to consider for anyone considering day trading as an investment strategy. Only 3% of day traders make consistent profits.

How do you know if stock will go up?

In large part, supply and demand dictate the per-share price of a stock. If demand for a limited number of shares outpaces the supply, then the stock price normally rises. And if the supply is greater than demand, the stock price typically falls.

The reality is that consistently making money as a day trader is a rare accomplishment. It's not entirely impossible, but it's certainly an imprudent way to invest your hard-earned cash. For people considering day trading for a living, it's important to understand some of the pitfalls.

- Candlestick.ai is one of the best AI stock picker services for beginners. ...

- TrendSpider is an established stock research and analysis platform that offers a wide range of features. ...

- TipRanks is a popular stock research platform that supports all US-listed stocks and ETFs.

Yes, no mathematical formula can accurately predict the future price of a stock. Probability theory can only help you gauge the risk and reward of an investment based on facts.

It is not currently possible to predict stock prices in a deterministic sense - you can't know for certain what stock prices or other financial prices (eg.

A common approach for new day traders is to start with a goal of $200 per day and work up to $800-$1000 over time. Small winners are better than home runs because it forces you to stay on your plan and use discipline. Sure, you'll hit a big winner every now and then, but consistency is the real key to day trading.

Many people have made millions just by day trading. Some examples are Ross Cameron, Brett N. Steenbarger, etc. But the important thing about day trading is that only a few can make money out of day trading and the rest end up losing their entire capital in day trading.

Based on the 1% rule, the minimum account balance should, therefore, be at least $5,000 and preferably more. If risking a larger amount on each trade, or taking more than one contract, then the account size must be larger to accommodate. To trade two contracts with this strategy, the recommended balance is $10,000.

- Look for companies with a competitive advantage. ...

- Watch for key market trends. ...

- Monitor volume and price. ...

- Identify companies with strong fundamentals. ...

- Track a stock's relative strength. ...

- Keep an eye out for catalysts. ...

- Exit at your target price.

- Vikas Ecotech Ltd.

- Comfort Intech Ltd.

- Rajnandini Metal Ltd.

- G G Engineering Ltd.

- Indian Infotech & Software Ltd.

- Genpharmasec Ltd.

- Accuracy Shipping Ltd.

- Goyal Aluminiums Ltd.

How do beginners trade penny stocks?

- Open a live trading account. ...

- Fund your account. ...

- Research to find the right stocks for you. ...

- Decide if you want to buy or sell. ...

- Manage your risk. ...

- Determine your position size and place the trade. ...

- Monitor your position and close your trade.

- Moving average (MA)

- Exponential moving average (EMA)

- Stochastic oscillator.

- Moving average convergence divergence (MACD)

- Bollinger bands.

- Relative strength index (RSI)

- Fibonacci retracement.

- Ichimoku cloud.

This indicator marks big candles (major moves in percentage) on the chart and, more importantly, you will be able to add an alert to them. Indicator checks if the height (high - low) of last closed candle is bigger than the specified percent of the close of its previous.

MACD. Moving average convergence divergence (MACD) indicator, set at 12, 26, 9, gives novice traders a powerful tool to examine rapid price change. This classic momentum tool measures how fast a particular market is moving while it attempts to pinpoint natural turning points.

What Is the 11am Rule in Trading? If a trending security makes a new high of day between 11:15-11:30 am EST, there's a 75% probability of closing within 1% of the HOD.